While we debate one man’s guilt, a parade of defaulters continues to walk free

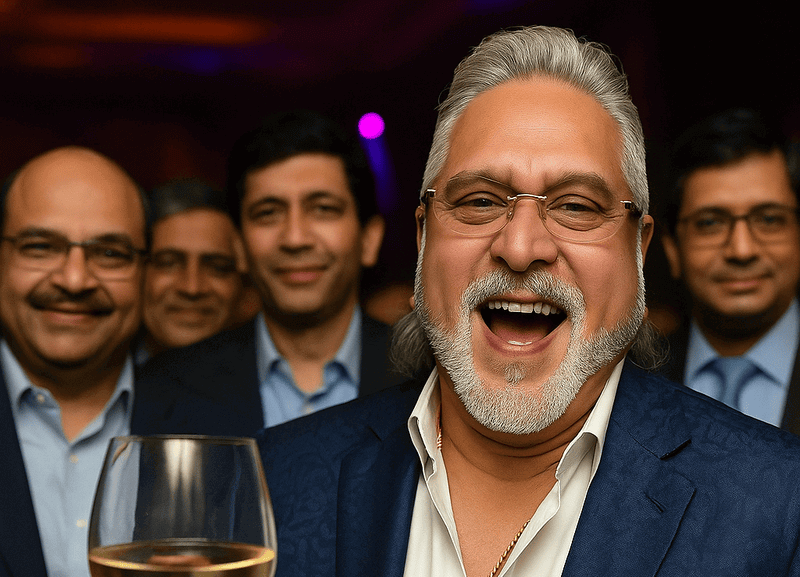

Vijay Mallya’s recent podcast has reignited familiar debates about his guilt or innocence, the accuracy of debt figures, and the fairness of his treatment. But here’s the uncomfortable truth: whether Mallya is telling the truth or spinning another elaborate tale is becoming irrelevant. What matters is the alarming pattern he represents—and our collective failure to address it.

The Parade Never Stopped

While we’ve spent nine years dissecting Mallya’s every claim, a steady stream of high-profile defaulters has quietly exited India, taking with them staggering amounts of public money. The numbers tell a devastating story:

Nirav Modi and Mehul Choksi: The uncle-nephew duo orchestrated the Punjab National Bank fraud worth approximately ₹13,000-14,000 crore through fraudulent Letters of Undertaking, making it one of India’s largest banking frauds.

The Top 10 Defaulters: As of March 2023, India’s top ten wilful defaulters collectively owed ₹40,825 crore to banks.

The Bigger Picture: By March 2023, wilful defaulters across India had ballooned to ₹3,53,874 crore involving 16,883 accounts—an increase of nearly ₹50,000 crore in just one year.

Beyond the headline cases of Nirav Modi, Mehul Choksi, Lalit Modi, Jatin Mehta, and Pushpesh Baid lies an even more troubling reality. Banks filed suits against 36,150 NPA accounts to recover ₹9.26 lakh crore in FY23 alone—a figure so massive it dwarfs individual cases yet receives fraction of the media attention.

The pattern is depressingly consistent: accumulate massive debts, exploit regulatory loopholes, create complex corporate structures to obscure fund flows, and when the house of cards collapses, catch the next flight out. What varies is only the scale and the sophistication of the exit strategy.

The Real Malya Legacy

Whether Mallya actually siphoned ₹9,000 crore or genuinely faced circumstances beyond his control is almost beside the point now. His real legacy isn’t the collapse of Kingfisher Airlines—it’s the blueprint he provided for evading accountability. He showed that India’s wealthy elite could default on massive loans and face no meaningful consequences beyond media criticism and legal proceedings they could easily avoid by relocating.

Mallya’s comfortable life in the UK, despite years of legal battles, sends a clear message to potential defaulters: the risk-reward calculation heavily favors flight over fight. Why face Indian courts when you can live comfortably abroad while lawyers handle the paperwork?

The System’s Stunning Inability to Learn

Each new fugitive case reveals the same systemic weaknesses: inadequate due diligence by banks, delayed recognition of stressed assets, weak early warning systems, and toothless recovery mechanisms. Yet we continue treating each case as an isolated incident rather than symptoms of a broken system.

The scale of the problem is staggering. The Enforcement Directorate has attached assets worth ₹18,170 crore from just three fugitives—Mallya, Modi, and Choksi—yet the total wilful default amount has grown to ₹3,53,874 crore involving 16,883 accounts by March 2023.

Consider the timeline: Mallya left in 2016, but we’re still arguing about his debt calculations in 2025. Meanwhile, Nirav Modi executed a ₹14,000 crore fraud at PNB, Mehul Choksi pulled off similar schemes, and others have followed suit. Our investigative agencies are always reactive, never proactive.

Even India’s ambitious solution—the National Asset Reconstruction Company (NARCL) or “bad bank”—has fallen dramatically short. Since its establishment in October 2021, NARCL has acquired only ₹21,350 crore of outstanding debt against its self-imposed ₹50,000 crore target.

The Cost of Our Obsession

Our fixation on relitigating past cases comes at a staggering opportunity cost. Every hour spent debating whether Mallya owes ₹6,000 crore or ₹9,000 crore is an hour not spent strengthening systems to prevent the next fraud. Every press conference about recovering assets from decade-old cases is energy not directed toward real-time monitoring of current risks.

The numbers are sobering: while the government celebrates recovering ₹22,000 crore from financial fugitives in 2024, the total amount owed by wilful defaulters has reached ₹3,53,874 crore—meaning recoveries represent barely 6% of the total problem.

The banking sector continues to grapple with stressed assets, but instead of focusing on improving credit evaluation, risk management, and early intervention systems, we’re still celebrating marginal recoveries from cases that should never have reached crisis point.

The Deterrent That Never Was

Perhaps most troubling is how spectacularly we’ve failed at deterrence. Mallya’s case was supposed to send a strong message to potential defaulters. Instead, it demonstrated that wealthy fugitives could maintain comfortable lifestyles abroad while their cases dragged through courts for years. The message received was likely the opposite of what was intended.

When business leaders see Mallya giving podcast interviews from his UK residence nine years after fleeing, what lesson do they draw? That the consequences of default are manageable, especially compared to the alternative of facing India’s slow-moving justice system.

The Future We’re Not Preparing For

While we debate Mallya’s version of events, several concerning trends are accelerating:

Digital complexity: Future frauds will be more sophisticated, involving cryptocurrency, offshore digital assets, and blockchain-based schemes that make traditional asset recovery even more challenging.

Regulatory arbitrage: As global financial systems become more interconnected, defaulters have more options for relocating assets and themselves beyond Indian jurisdiction.

Time decay: Each year of delay in addressing systemic weaknesses makes recovery harder and deterrence weaker. The longer we take to reform, the more attractive India becomes as a source of easy money for those planning exits.

What Actually Needs to Change

Instead of endlessly relitigating past cases, we need:

Real-time monitoring systems that can flag suspicious transactions and corporate behavior before they become billion-dollar problems.

Preventive detention laws for financial crimes that prevent suspects from leaving the country while investigations are ongoing.

International cooperation frameworks that make it harder for fugitives to establish comfortable lives abroad.

Judicial reforms that ensure financial crime cases are resolved within defined timeframes, not decades.

Cultural change in banking that prioritizes risk assessment over relationship-based lending.

The Inconvenient Truth About Justice

Here’s what we don’t want to admit: whether Mallya is guilty or innocent won’t change the fact that our system failed. If he’s guilty, we failed to prevent and prosecute the crime effectively. If he’s innocent, we failed to protect a businessman from systemic pressures and scapegoating. Either way, the system needs fundamental reform.

Moreover, our pursuit of individual villains provides comforting closure while allowing institutional failures to persist. Making Mallya the face of banking fraud lets everyone else—regulators, bank officials, politicians—escape scrutiny for their roles in enabling systemic weaknesses.

The Choice We Face

We can continue spending the next decade debating whether Mallya’s podcast revelations are truthful, parsing every claim about political meetings and debt calculations. Or we can accept that the past is past and focus obsessively on ensuring this never happens again.

The next Mallya is probably already out there—accumulating debt, exploiting loopholes, planning exit strategies. While we argue about the last one, are we doing anything meaningful to stop the next one?

The real question isn’t whether Mallya is telling the truth. It’s whether we’re serious about learning from this mess or just interested in endlessly relitigating it. Because at the current pace, we’ll still be debating Mallya’s guilt when the next generation of fugitives is booking their flights out of India.

That’s the future we’re sleepwalking toward—and it’s far more dangerous than anything one fallen businessman could say in a podcast.